Promotional Content

Why EBIDTA Suddenly Dictates Who Wins in Clean Energy—and How to Get Ahead

EBIDTA just jumped into the spotlight.

Yesterday’s earnings calls, today’s tax bill, tomorrow’s board meeting—everyone is talking about the metric that now decides whether a clean-energy portfolio is seen as a rising star or a sinking ship.

The shockwave most teams missed

The newly enacted OBBBA legislation ties several federal incentives directly to EBIDTA performance starting next fiscal year. On paper, it looks like a simple tweak. In practice, it means every watt your assets fail to deliver drags down the number Wall Street—and Washington—are watching. Yet most solar and wind operators are still buried in disconnected SCADA alarms, hoping monthly spreadsheets will magically reveal lost margin. They won’t.

The hidden drain on your earnings

Analysts agree: the clean-energy sector should enjoy enviable EBIDTA margins thanks to low fuel costs. So why are investors whispering about “under-performance risk” in otherwise healthy portfolios? Because revenue is leaking through thousands of unnoticed micro-faults—string outages, BESS degradation, inverter curtailments—that legacy monitors flag but never fix. Each unresolved alert quietly chips away at uptime, SRECs, and production-based PPAs. When the year closes, the gap shows up in one nasty place: EBIDTA.

The deeper problem nobody is naming

You don’t have a hardware crisis. You have a data-to-action gap. Siloed monitoring tools drown O&M teams in noise, finance teams in doubt, and executives in surprise write-downs. The real cost isn’t the faults—it’s the hours spent guessing which fault matters. That cognitive drag translates directly into weaker EBIDTA, shaky covenants, and tense investor calls.

Enter the intelligence layer built for this moment

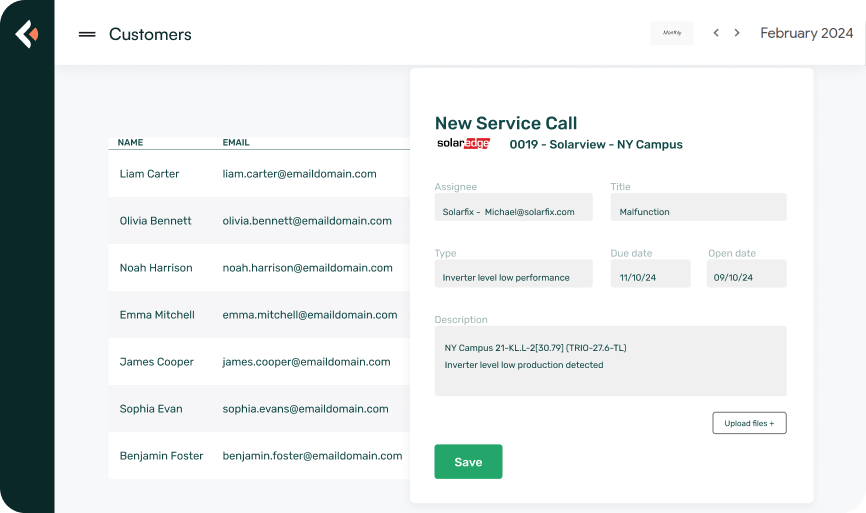

That’s why we built enSights, the only platform that natively integrates field, operational, and financial data—then uses AI to rank every issue by its dollar impact. It doesn’t just warn you something is wrong; it shows you why it matters and how to fix it inside the same screen. From inverter to invoice, enSights turns noise into net income.

- Native edge-to-ERP integration eliminates missing data, giving finance teams real-time production-to-payment visibility.

- Impact scoring translates kWh losses into EBIDTA hits—so you always chase the biggest dollar first.

- Built-in diagnostics, ticketing, and vendor workflows cut mean-time-to-resolution by 40%, recovering revenue before the quarter closes.

Proof in the portfolio

Independent power producers beta-testing enSights saw a 7.5% revenue uplift within 90 days. One COO told us, “We found $2.1 million in annual EBIDTA just by killing phantom curtailments.” Another O&M director slashed report prep from two days to twenty minutes—auditors now trust their numbers on sight.

Why the timing is critical

Come January, financiers will benchmark tax-adjusted income directly against EBIDTA. Miss targets, and incentives shrink; hit them, and capital gets cheaper. The window to hard-wire accountability into your assets is closing fast. Wait six months and you’ll be chasing losses the IRS already counted.

The two paths diverge

- Keep cobbling together SCADA dashboards, hoping analysts overlook the margin dip.

- Or embrace the new EBIDTA reality, armed with a platform purpose-built to convert anomalies into cash.

Most teams choose path one out of habit—until a covenant breach forces change. The winners are moving now.

What tomorrow looks like with enSights

Picture your next earnings call. You open the deck and show a tidy chart: production variance, root cause, corrective action, dollars recovered—every line auto-generated by enSights. The CFO nods, the board smiles, and investors text, “Add exposure.” That’s not a fantasy; that’s our users’ Tuesday.

Ready to see how much EBIDTA is hiding in your data? Halfway through a pilot, clients usually uncover six-figure upside—often in the first week.

But discovery is just the beginning… Schedule a live look

Under the hood—our unique mechanism

- Source-level ingestion: enSights taps edge devices, weather feeds, CMMS logs, and ERP records directly, standardizing them instantly.

- AI impact engine: Proprietary models validate anomalies against historical baselines and price curves, then rank by lost revenue, compliance risk, and SLA urgency.

- Action fabric: One-click tickets route fixes to field techs, OEMs, or finance, while continuous cost tracking feeds straight into your EBIDTA forecast.

This closed loop is why our clients stop reacting to alarms and start resolving root causes—faster than anyone else in the sector. Curious what it looks like in action? Watch a 3-minute walkthrough

What skeptics ask (and how we answer)

• “Isn’t this another layer of software?”

No—enSights replaces three. Users cut license spend by 28% on day one.

• “My data’s a mess.”

Perfect. We built edge connectors that clean it at ingestion, so your team starts with truth, not turmoil.

• “Prove the ROI.”

Our contracts include success benchmarks. If we don’t hit them, we extend your license free until we do. See the ROI calculator

The next step is risk-free

Book a 20-minute discovery call. We’ll plug in one asset, expose the revenue leaks, and project the EBIDTA lift. If you’re not impressed, we part as friends.

But remember: every unaddressed fault between now and fiscal year-end is a line item investors will see. The smartest operators are locking in intelligent resolution before the new rules bite.

Don’t let under-performance decide your narrative. Claim your priority slot today and turn insight into EBIDTA—before someone else does.