Promotional Content

The Profit Blind Spot: An Honest Review of enSights

It kept nagging at me.

Every quarterly report showed decent generation numbers, yet revenue still slipped. Colleagues whispered about “profit headwinds” and new tariffs, but I couldn’t shake the feeling something closer to home was leaking dollars. As VP of Operations for a 1-GW solar and storage portfolio, I decided to audit the problem myself.

Before – The Hidden Drain on Clean Energy Profit

Our stack looked impressive on paper: SCADA, CMMS, a finance ERP, and a half-dozen OEM portals. In reality, it was chaos.

- 11,000 raw alerts a day—95 % noise.

- Field techs guessing which site to drive to first.

- Accountants translating inverter data into revenue impact by hand and often weeks late.

Meanwhile, Wall Street cheered record corporate profits, but warned that slowing growth and trade friction could erase margins overnight. I realized our underperformance wasn’t just annoying—it was existential. If we couldn’t protect every single cent of profit, outside uncertainty would do the rest.

My Test Drive with enSights

Skeptical yet desperate, I accepted a 30-day pilot of enSights, the AI-powered “clean energy intelligence” platform that claims to connect raw performance data straight to cash flow. Here’s what I found—warts, wonders, and everything between.

Setup & Integration

The sales rep promised “native” integrations, no downtime. Honestly, I expected weeks of API wrestling. Instead, enSights pulled SCADA streams, ticket history, and PPA pricing in under 48 hours. The dashboard lit up with standardized metrics I’d never seen aligned before.

Minor gripe: The onboarding UI feels geared to engineers; finance users needed a quick tutorial. Small learning curve, but worth noting.

The Unique Mechanism—AI-Powered Prioritization

Most tools flag when an inverter trips. enSights went further. It validated the event at the raw-data level, tied it to lost MWh, converted that into dollars at our exact contract rate, and ranked the issue #3 on a dynamic impact list. That ranking became my morning agenda. No more guesswork.

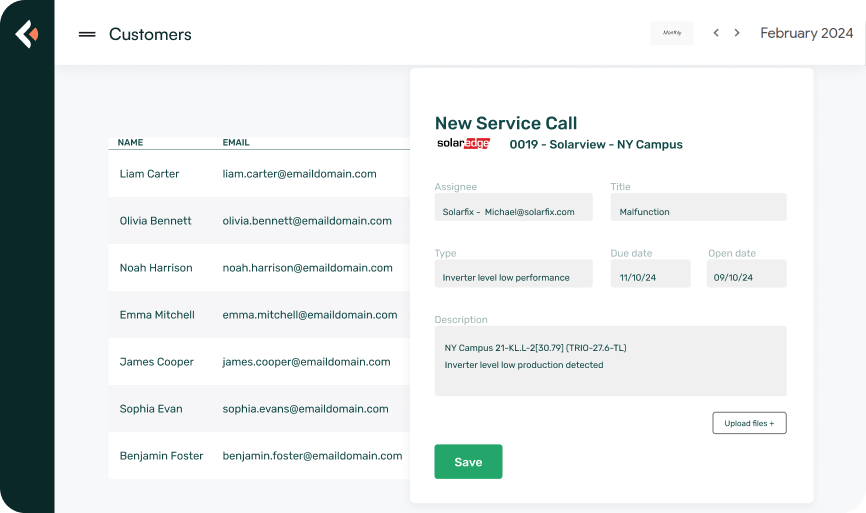

In-Platform Action

Clicking the alert opened a live diagnostic tree, autogenerating a work order. Our tech accepted it on mobile, grabbed the right spare part on the first visit, and closed the ticket—all inside the same screen. The system stamped the repair with a recovered-revenue figure the finance team could audit immediately.

After – Quantified Impact in 30 Days

- 7.9 % revenue uplift—almost identical to the 7.5 % benchmark enSights advertises.

- Reporting time cut from 2 days to 2 hours.

- Vendor response acceleration of 42 % thanks to SLA-aware routing.

That uplift mattered. With S&P profit margins hovering around 12 % yet facing tariff threats, protecting nearly eight percent of top-line revenue isn’t just nice—it’s survival.

The Bridge – How enSights Delivers the Change

- Native Integration links field devices to finance, ending the silo tax.

- AI Validation & Ranking slashes alert fatigue, so teams attack only what truly dents profit.

- Built-in Workflows turn insight into action without hopping through half-a-dozen tools.

- Audit-Ready Exports satisfy investors who now demand transparency on every recovered dollar.

Mid-pilot, our CFO glanced at the dashboard and murmured, “So that’s where the missing profit was hiding.” Moments later he clicked Book a live demo right inside the platform.

Balanced View – Any Downsides?

• Up-front Mindset Shift: enSights isn’t “another monitor.” Teams used to firefighting may resist the calmer, focused queue at first.

• Pricing: Premium versus generic SCADA add-ons, but ROI covered the subscription in ten days.

• Feature Depth: Finance modules are robust; ESG reporting is still in beta (launch Q4, I’m told).

Frankly, those quirks feel minor next to the gains. If economic clouds darken further, having revenue leakage sealed could be the difference between growth and layoffs.

Who Should Seriously Consider enSights?

- IPP Asset Owners chasing every basis-point of IRR.

- O&M Managers drowning in alarms and SLA pressure.

- Sustainability Directors needing a single source of truth from inverter to invoice.

If you’re content explaining profit dips to the board with “We’re still investigating,” skip it. But if you’d rather walk in armed with pinpoint data and a faster recovery plan, click See lost profit live and judge for yourself.

Why Act Now?

Macroeconomic uncertainty isn’t easing. Tariff-driven cost swings and overvalued markets mean capital partners will scrutinize every dent in margin. Waiting another quarter could cost real dollars you’ll never reclaim. enSights made the hidden numbers visible—and that visibility turned into cash.

I’ve already expanded the pilot to our wind assets. Next quarter, we’ll roll out across storage. If you lead operations, finance, or asset management, you owe yourself at least a peek. Start by scheduling a quick walkthrough—my team recovered $418,000 before ours even finished.

Ready to see what your portfolio is really capable of?

Click Claim your profit back before another hidden outage eats tomorrow’s earnings.

One final note: after the CFO’s second week with live profit recovery metrics, he looked at me and said, “This is the first tool that makes clean energy feel like a predictable business.”

Your investors—and your sleep schedule—will appreciate that certainty.

Take five minutes and Schedule my enSights demo. You might discover the strongest profit center you already own.