Promotional Content

5 Profit Leaks Hiding in Your Clean-Energy Portfolio (And the AI Fix That Plugs Them in Days)

You’re losing money right now.

That stings, but it’s true.

Global profits look rosy on CNBC, yet new tariffs, rate shocks, and sky-high valuations mean every dollar of wasted generation hurts more than ever. The winners are the asset owners who can squeeze extra megawatt-hours (and margin) from the gear they already paid for. The losers? They’ll keep praying their legacy monitoring tools will magically improve.

It doesn’t have to be that way. Below are the five silent Profit leaks we uncover in 9 out of 10 portfolios—and the simple AI workflow that seals each one before it drains another cent.

1. Phantom Curtailments That Never Hit Your P&L

Most SCADA dashboards show power output, but they rarely reveal why an inverter throttled back at 2:14 p.m. Was it a grid dispatch, an HVAC trip, or a firmware bug? Without context, accounting books the dip as “normal variability.” Multiply that by hundreds of events and you gift your utility thousands of dollars.

The enSights Edge: We ingest raw dispatch, weather, and device logs, validating every dip against market signals. When curtailment is unjustified, we flag the root cause and its dollar value—often recouping 2–3% annual Profit in hours.

2. Alert Fatigue That Masks True Emergencies

Technicians confess they delete entire inbox folders of noise just to stay sane. The risk? The one alert that matters—the stuck tracker dragging output down 8%—gets buried.

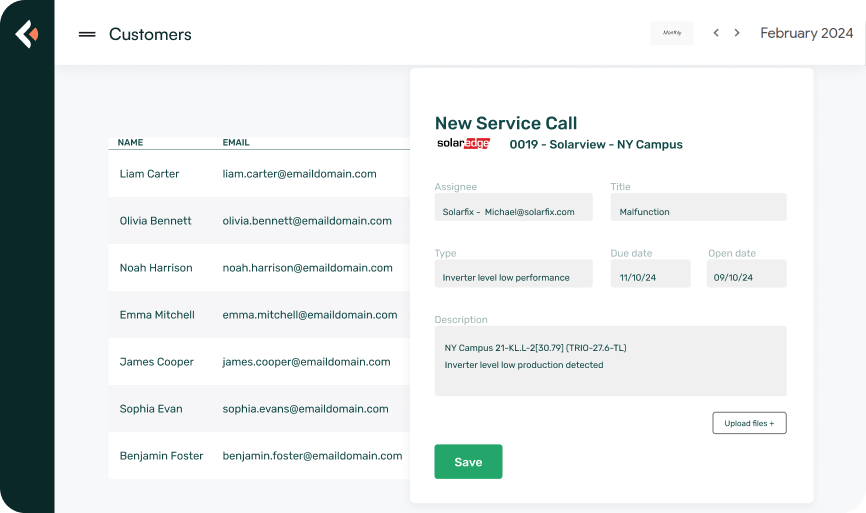

The enSights Edge: Our AI assigns business-impact scores to every anomaly. Anything below a preset threshold is muted; the top 1% becomes an auto-ticket with SLA timers. Teams finally focus, cutting mean-time-to-repair by 40%.

3. Missing Revenue From Mismatched Meters

Billing meter says 5,002 MWh. Plant historians total 5,209 MWh. Finance shrugs and sides with the utility because reconciling is a spreadsheet nightmare. Congratulations—you just handed over 207 MWh of clean energy (and cash).

The enSights Edge: We reconcile inverter, meter, and ISO settlement data in one ledger, exposing discrepancies before the close. Clients using this flow average a 7.5% year-one Profit uplift.

Ready to see your own delta? Book your enSights demo now and get a free meter-match report.

4. Slow Vendor Response That Blows Through SLAs

A failed combiner box shouldn’t be a crisis, yet every hour it’s offline costs $1,300 in lost generation. Emails bounce between EPC, O&M, and owner while the sun keeps shining on idle panels.

The enSights Edge: Our ticketing engine tags each issue with contractual SLA clocks and auto-alerts the responsible vendor. Escalation ramps the moment a deadline slips. Customers report 40% faster vendor fixes and newfound Profit they once wrote off.

Stop chasing vendors—make them chase you. See how inside this 15-minute walkthrough Claim your priority slot.

5. Monthly Reports That Arrive When It’s Too Late to Act

By the time legacy software spits out a PDF, the quarter is over, tariffs have shifted, and management is grilling you about margin compression. Hindsight analysis doesn’t protect future cash flow.

The enSights Edge: Live dashboards roll operational, financial, and compliance KPIs into a single “Inverter-to-Invoice” view. Executives spot trends in real time, pivot dispatch strategies, and lock in gains before macro headwinds strike.

See tomorrow’s P&L today—Launch your live preview in minutes.

Why These Leaks Matter More in 2025

• Tariffs just shaved 35% off auto-sector earnings. Solar isn’t immune.

• Investors call the S&P “overvalued by 15%” if projected Profits miss.

• Capital for new builds is tight—boards demand higher returns on existing assets.

That economic squeeze turns every kilowatt-hour you recover into outsized shareholder value. enSights is the only platform built to convert hidden data noise into hard Profit—fast enough to matter in this volatile market.

The One-Click Path From Insight to Impact

- Integrate at the Source – Secure APIs pull from field devices, SCADA, and finance with zero downtime.

- Prioritize by Dollar Value – AI ranks issues by expected cash impact so you always tackle the top line item first.

- Act Seamlessly – Built-in diagnostics and vendor workflows close the loop without hopping tools.

- Prove It – Audit-ready reports tie every fix to recovered revenue for instant executive buy-in.

Hundreds of portfolios are already sealing their leaks. The question is: Will yours be next, or will Profit keep slipping through cracks you can’t even see?

Your move. Schedule your private demo before the next tariff headline lands.